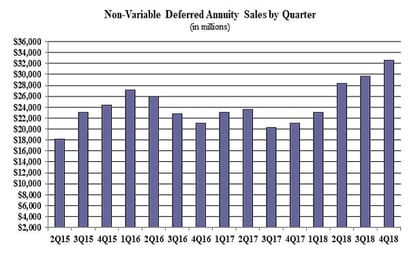

Sales of U.S. individual non-variable annuities rocketed to $33 billion in the fourth quarter of 2018.

That’s up 54% from the total for the fourth quarter of 2017, according to new survey data from Wink Inc.

That enormous increase follows a 46% year-over-year sales increase in the third quarter.

(Related: Wink Posts the Rest of the Annuity Sales Increase Story)

Wink based the latest non-variable annuity sales figures on results from a survey of most of the issuers in the non-variable annuity market.

The sample included 60 issuers of indexed annuities, 54 issuers of traditional fixed annuities, and 68 issuers of multi-year guaranteed annuity (MYGA) contracts.

Low interest rates, competition from booming stock prices, and concerns about the U.S. Department of Labor’s first big fiduciary rule project held down annuity sales in 2016 and 2017. Sales began to recover in 2017, as policymakers in Washington began to pull away from the Obama-era fiduciary rule effort.

March 20, 2019 at 04:22 PM

March 20, 2019 at 04:22 PM