A big 80% of defined contribution plan participants showed interest in putting all or some of their retirement money into guaranteed lifetime income products as either an in-plan purchase or one made at retirement, the 2018 Retirement Confidence Survey found.

Perhaps without realizing it, those individuals ages 25 and older may be talking annuities.

The survey of 2,042 workers and retirees was conducted last January by the Employee Benefit Research Institute (EBRI) and research firm Greenwald & Associates.

It’s indeed possible that the long-established attitude about annuities may be starting to change.

For the last few years, some financial advisors have become increasingly in favor of certain types of annuities used where appropriate.

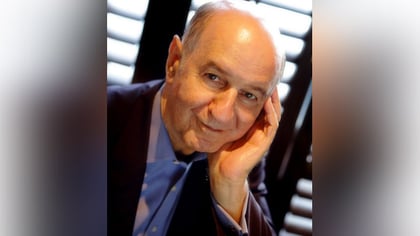

“An immediate annuity is absolutely going to be extraordinarily important to consider, especially if, like me, you believe that market returns will be modest over the next decade or two,” says Harold Evensky, chair of Evensky & Katz/Foldes Financial Wealth Management, whose main office is in Coral Gables, Florida.

He continues. “Another reason I’ve changed my opinion about the importance of annuities — in particular, the immediate annuity — is because it’s the only investment that will guarantee you’ll have an income stream no matter how long you live. And with mortality insurance, the annuity has potential for an extra return.”

But two major issues concerning annuities still cloud the picture: One, clients tend to be reluctant to lose control of their retirement savings to an insurance company and forgo the opportunity to make high returns if markets do well. Two, advisors don’t earn residual revenue once an annuity is purchased and therefore aren’t jumping up and down to recommend them.

“Because annuities aren’t a financial benefit to them, advisors don’t offer them. Most advisors shy away. That’s a big problem in the industry,” says Anna Felix, an advisor with CalChoice Financial in Turlock, California.

“Annuities can be a good thing on a case-by-case basis,” Felix says. “Some aren’t good, but some are amazing.”

Only 46% of consumers were aware that annuities provide guaranteed lifetime income, a 2017 survey by Jackson National Life Insurance and the Insured Retirement Institute found.

During the extended period of low interest rates, there’s hardly been a pressing argument to incorporate most types of annuities into financial plans.

But, says Evensky, “the bottom line is that financial advisors absolutely should at least be learning about immediate annuities and start factoring them into their analyses. I believe there’s not much risk in waiting [to buy] till interest rates go back up, but advisors need to start considering them.”

December 11, 2018 at 10:49 AM

December 11, 2018 at 10:49 AM