Edelman Financial Engines, the country’s largest RIA by AUM, has modified its fee structure following its merger with Financial Engines, which was completed in late July.

According to the firm’s latest Form ADV, Part 2, filed on Nov. 1, the annual wrap fee for retail accounts, known as EMAP for Edelman Managed Asset Program, has been cut, but only slightly for accounts with AUMs above $150,000.

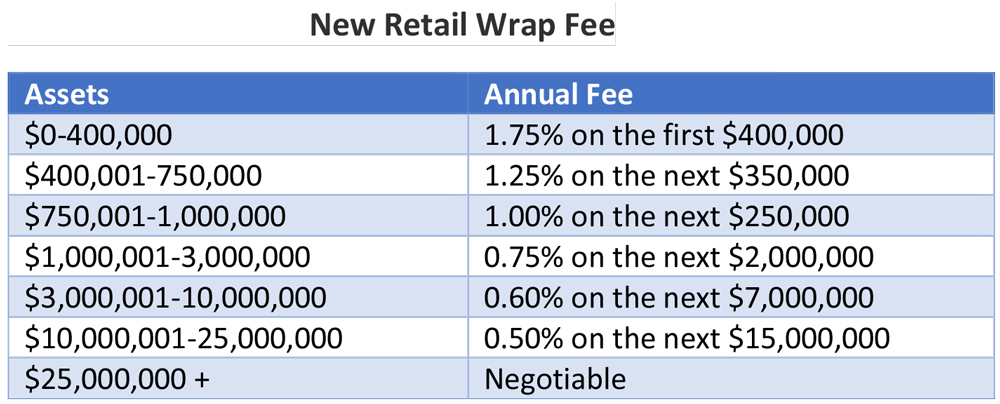

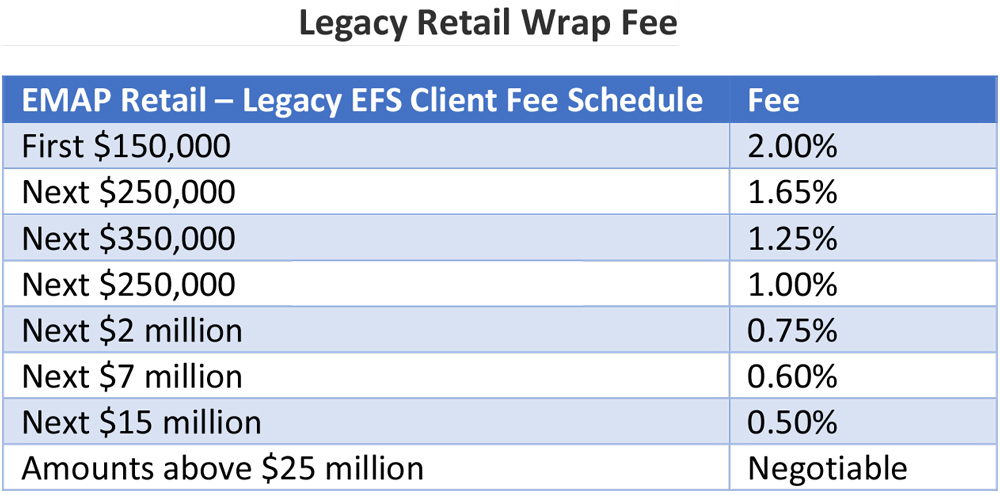

For new accounts with $150,000 or less in assets, the annual fee is 1.75% versus 2% previously, as seen below in the charts from the ADV filing.

The fee cuts for accounts with more than $150,000 are negligible. For example, new accounts with $400,000 in assets will pay 1.75% versus 1.78% for legacy accounts, based on calculations using the new asset breakpoints. New accounts with $1 million in assets will pay 1.3875% versus 1.4% previously. It’s expected that legacy accounts will move to the new fee schedule in early 2019.

The fee cuts for accounts with more than $150,000 are negligible. For example, new accounts with $400,000 in assets will pay 1.75% versus 1.78% for legacy accounts, based on calculations using the new asset breakpoints. New accounts with $1 million in assets will pay 1.3875% versus 1.4% previously. It’s expected that legacy accounts will move to the new fee schedule in early 2019.

In addition to the fees above, which include costs for trading and custodial services, clients pay roughly another 30-35 basis points for the mutual funds or ETFs in which their accounts are invested. The EMAP accounts consist primarily of no-load mutual funds and ETFs in several asset classes and market sectors including domestic and international stocks, global bonds and alternative investments with strategies that range from conservative to aggressive.

In addition to the fees above, which include costs for trading and custodial services, clients pay roughly another 30-35 basis points for the mutual funds or ETFs in which their accounts are invested. The EMAP accounts consist primarily of no-load mutual funds and ETFs in several asset classes and market sectors including domestic and international stocks, global bonds and alternative investments with strategies that range from conservative to aggressive.

December 06, 2018 at 01:23 PM

December 06, 2018 at 01:23 PM