The CFP Board’s Center for Financial Planning isn’t just talking about diversifying the advisor workforce, it’s trying to do something about this stubborn problem for the profession, and CFPs themselves are at the center of that solution.

Based on research findings that were presented at its first Diversity Summit in late October, the Center learned that it’s critical that prospective planners first become aware of the profession and find role models to be attracted to joining the profession.

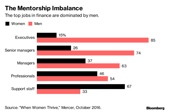

But the second and perhaps greater solution to diversifying the advisor population is that those nascent planners receive career support — specifically mentors — to help them stick with their careers through the challenging first few years of being a new planner.

That’s why, said the Center’s executive director, Marilyn Mohrman-Gillis, that it is expanding its highly successful WIN-to-WIN women-to-women mentoring program to embrace all prospective CFP professionals.

(Related: Inside UBS’ Huge Diversity Push)

In an interview, Mohrman-Gillis reported that 700 women CFPs had participated in the WIN-to-WIN program since its launch two years ago, resulting in 1,670 mentor-mentee engagements.

She said that while those 700 mentors only had a short-term obligation to help those being mentored, such as helping them prepare for and eventually pass the CFP exam, in many cases the engagements had turned into longer-term relationships, helping women with “career choices and advancing in the profession.”

In the expanded mentor program, the Center has made it easier to sign up for the program, to secure a mentor, and then to “find somebody to work with,” Mohrman-Gills said.

The mentor program provides for “enhanced connection opportunities,” allowing a mentee to, for example, “work with someone of same race or ethnicity,” since the platform includes photos of available mentors. The mentees can also choose a mentor who is in the same geographical area, or has expertise in specific financial planning topics like estate planning or charitable giving.

“We’ve set up clear expectations for the mentor and mentee; more of a road map” in the expanded program, Mohrman-Gillis said. That map includes making sure the mentors know all the available tools that the Board provides to prospective CFPs, such as the CFP Board Candidate Forum to help prepare for the CFP exam for the first time, or until they pass the exam.

When asked whether that roadmap includes specific ways for the mentor and mentee to communicate, Mohrman-Gillis says the process is “up to the mentor and mentee,” and could encompass one or more telephone calls or email exchanges or, if they live near each other, person-to-person meetings.

December 05, 2018 at 01:53 PM

December 05, 2018 at 01:53 PM