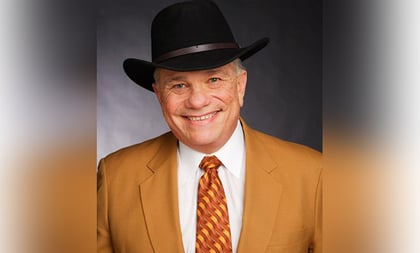

Maverick financial advisor Bert Whitehead is systematically retiring, but he’s far from retiring his unwavering stance that asset-based fees “poison” the FA-client relationship.

In an interview with ThinkAdvisor, the outspoken fee-only planner and tax attorney — for 30-plus years, famed Dr. Andrew Weil’s financial advisor — opines on how AUM-based comp, which poses a conflict of interest, he says, encourages clients to lie to their advisors.

Whitehead, 73, began as a part-time FA 46 years ago and ultimately built his practice into the nationwide Alliance of Comprehensive Planners (ACP), now based in Wilmington, North Carolina. His behavioral approach provides integrated advice on investing, tax planning, insurance and real estate, for which ACP FAs charge clients an annual retainer.

With three years to go on his succession plan, the innovative Whitehead still serves, as an independent contractor, 35 high-net-worth longtime clients. Last year he sold his original RIA, Cambridge Connection, which managed $350 million in client assets.

ACP’s annual conference, set for Nov. 6-9 in Miami, will not only deliver FA training but celebrate the evolution of Whitehead’s business and publication of the fifth edition of his bestseller, “Why Smart People Do Stupid things With Money: Overcoming Financial Dysfunction.” Dr. Weil, a pioneer in integrative medicine, penned the foreword.

ThinkAdvisor recently held a phone interview with Bisbee, Arizona-born Whitehead, speaking from Tucson. Before launching his practice full time, he sold computers for the Burroughs Corp., later moving up to become its director of fair employment practices.

Here are excerpts from our conversation:

THINKADVISOR: How did you acquire Dr. Andrew Weil as a client?

BERT WHITEHEAD: He was referred by his massage therapist. When I started out, most of my clients were small businesses. Massage therapists turned out to be some of my best referrers because while people are getting a massage, they talk about their money.

You wrote the book, “Why Smart People Do Stupid Things With Money.” What’s the stupidest?

As [comic-strip character] Pogo said: “We have met the enemy, and he is us.” It’s in the behavioral parts of financial planning because people make financial decisions based on emotion — and that’s the hardest thing to break.

What are your thoughts about the demise of the Labor Department’s fiduciary standard rule? The DOL said that AUM [-based compensation] doesn’t meet a fiduciary standard because advisors charge different rates on different asset classes. That sets up a bias in pricing where the advisor has an incentive to over-emphasize the asset class paying the highest rate.

How does that affect the advisor-client bond?

It poisons the relationship because the client knows about it; so they don’t tell their advisors all the assets they have. Not only are clients lying to their advisors, but the advisors know they’re lying — and yet they’re trying to do asset allocation. That’s preposterous!

You and the National Association of Personal Financial Advisors (NAPFA), on whose comp committee you served, had a falling out over the conflict of interest you perceive. Please explain.

About 80% of NAPFA members use assets under management [for comp]. I took a very hard stance [in 2011] that AUM [comp] didn’t meet a fiduciary standard. In [2015], the issue came up again, and [I did] a lot of press about it. NAPFA got really upset and asked me to resign from the committee.

And you did?

I agreed because I knew I wasn’t going to win. Afterward, people on the committee came up to me at the NAPFA convention and said, “What the Department of Labor said [via its fiduciary rule] is exactly what you were talking about.” So I felt vindicated.

Are you still a practicing tax attorney?

September 24, 2018 at 02:35 PM

September 24, 2018 at 02:35 PM