Efforts by drugmakers to thwart less-expensive rivals for pricey biologic medicines cost the U.S. health care system billions of dollars last year, the Food and Drug Administration’s chief said in laying out a plan to end such practices.

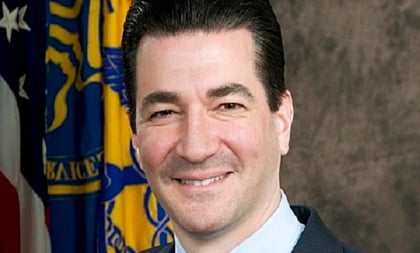

The agency wants to bring greater attention to the market for the complex drugs, which are generally injected or infused. It plans to work with the Federal Trade Commission to stop “gaming tactics” like piling up patents to extend the commercial dominance of brand-name medicines, FDA Commissioner Scott Gottlieb said in a speech on Wednesday in Washington.

Gottlieb said he also wants Congress’s help to close any loopholes that enable drugmakers to hinder competition from so-called biosimilars.

“Competition is, for the most part, anemic,” Gottlieb said in a speech to the Brookings Institution.

The commissioner blamed the lack of lower-cost options partly on what he has previously called a “rigged” system under which insurers and pharmacy-benefit managers (PBMs) enter exclusive contracts with drugmakers to cover only the older, original biologic drug in exchange for rebates or discounts.

In the new speech, Gottlieb called drugmakers’ long-dated contracts with “payers” — public and private insurers — a “toxin.”

(Related: U.S. to Make More Drugs Easily Available, Cutting Role Docs Play)

“The branded drug makers thwart competition by dangling big rebates to lock up payers in multi-year contracts right on the eve of biosimilar entry,” Gottlieb said.

A copy of the new speech is available here.

The FDA effort on biologics is one part of President Donald Trump’s blueprint for bringing down U.S. drug pricing. Unlike traditional pills made from chemical compounds, biologic drugs are made from living organisms. They have proved crucial to treating cancer and other diseases in recent years but have sparked heated complaints over what in some cases are record price tags.

AbbVie Inc.’s Humira, for example, a biologic that treats rheumatoid arthritis, is the best-selling drug in the world. Its base price before discounts and rebates is about $63,300 per year, according to data compiled by Bloomberg, and can trend higher depending on how often a patient needs to use it. But while the FDA has approved generic competition for Humira that could lower costs for patients, none of those drugs have hit the market.

Tying Up the Competition

Biologics, which are typically injected or infused into patients, are often referred to as specialty drugs. Only 1% or 2% of the U.S. population takes a specialty drug, according to a study last year from Rand Corp. Yet biologic drugs accounted for 38% of U.S. prescription-drug spending in 2015, Rand found.

In 2010, Congress granted the FDA the ability to approve generic versions of biologic drugs, which are called biosimilars because living organisms can’t be exactly copied. The agency approved the first biosimilar in 2015 and has since approved 10 more, including two Humira biosimilars from Amgen Inc. and Boehringer Ingelheim GmbH.

Only three of the 11 approved biosimilars have made it to the market. The FDA determined that the U.S. health system could have saved $4.5 billion last year if all nine of the biosimilars approved through 2017 had been on the market. The agency approved two biosimilars this year.

July 18, 2018 at 03:50 PM

July 18, 2018 at 03:50 PM