(Source:

IALC)

(Source:

IALC)

Do you analyze your clients by looking at what industry they work in? If not, maybe you should.

The State of America’s Workforce, a national study commissioned by my group, the Indexed Annuity Leadership Council (IALC), offers a comparison of workers by industry.

We segmented data by industry to see which workers are retirement ready, which workers rely the most on financial advisors for advice, and what workers seeking in retirement.

Here’s a look at three things found.

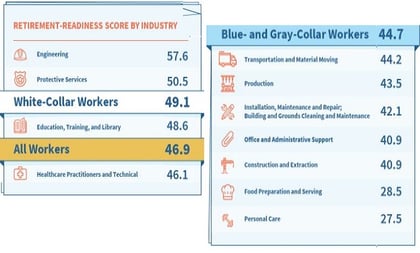

1. Retirement-Readiness Scores

Overall, the IALC’s newly released retirement-readiness scores show workers in two blue-and gray-collar fields, Engineering and Protective Services, are better prepared for retirement compared to all workers – outpacing even white-collar employees.

(Related: 3 Ways to Help Americans Save More for Retirement)

Yet, overall, workers in blue-collar and gray-collar industries are less prepared for their golden years, with eight of 11 scoring below the average retirement-readiness score for all American workers.

The numbers are especially bleak for workers in the Food Preparation and Serving, and Personal Care industries. Workers in these industries reporting having much less access to employer-sponsored plans — which, traditionally, have been provided workers with their main opportunities to accumulate retirement savings and create a source of lifetime income.

2. Workers’ #1 Retirement Goal

Lifetime income is workers’ number one retirement goal across industries.

Regardless of industry, the majority of America’s workforce is seeking stable income to last a lifetime. Unfortunately, more than three-quarters of workers plan on meeting this need by relying on Social Security.

Yet, with questions of whether Social Security will be enough to sustain lifestyle and the sustainability concerns of the program, many workers are turning to employers, financial advisors, and friends to learn about other accumulation and longevity products, such as fixed indexed annuities.

3. Use of Professional Help

June 11, 2018 at 07:21 PM

June 11, 2018 at 07:21 PM