What You Need to Know

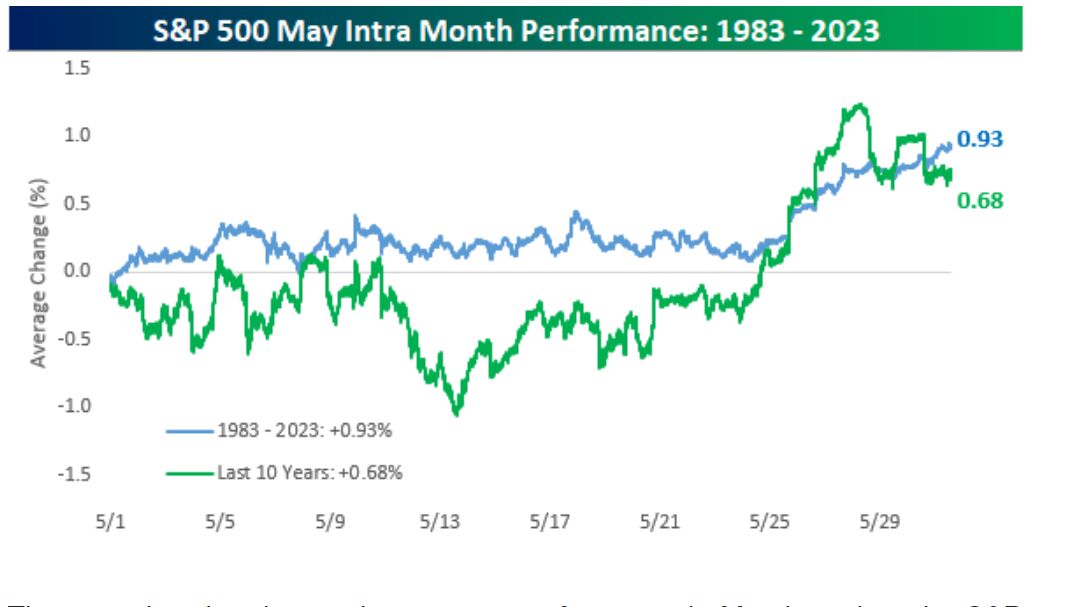

- The S&P 500 broke below 5,100, and is poised to halt a streak of five straight monthly gains.

- Equities are on track for their worst month since September on speculation the Fed will keep rates unchanged at a two-decade high on Wednesday.

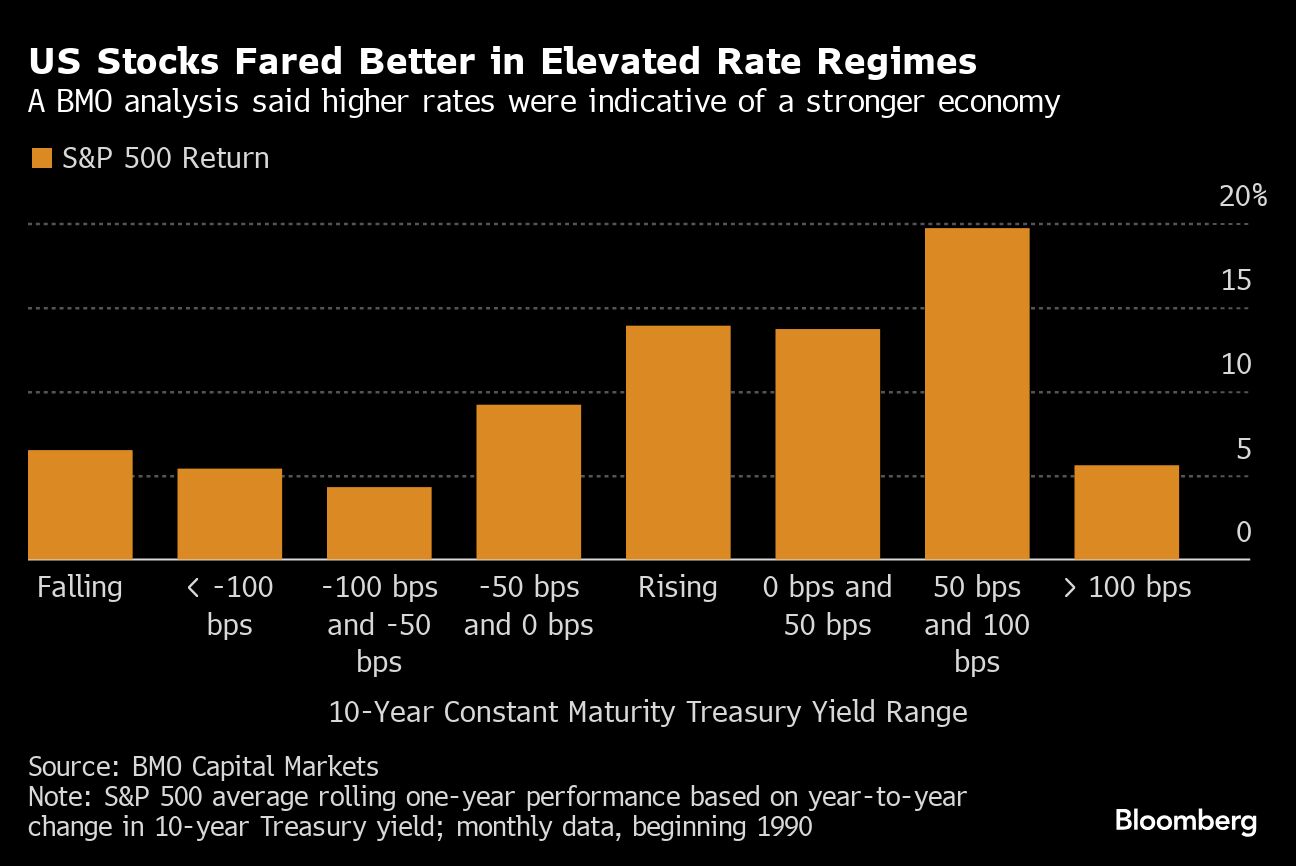

- Sticky U.S. inflation isn’t necessarily bad news for the stock rally as higher yields are a reflection of strong economic growth, according to HSBC strategists.

The stock market got hit after the latest economic data showed a plunge in consumer confidence and persistent wage pressures in the run-up to the Federal Reserve decision.

Equities were on track for their worst month since September on speculation the Fed will keep rates unchanged at a two-decade high on Wednesday — with officials unlikely to lower them anytime soon. That perception also drove bond yields up alongside the dollar.

The last time Fed Chair Jerome Powell spoke he pointed to the lack of further progress in bringing inflation down, and to enduring strength in the labor market.

The latest price data — in tandem with expectations for a robust employment report on Friday — aren’t likely to lead him to change his tune.

“Powell will need a lot more convincing at this point,” said Ian Lyngen at BMO Capital Markets.

The S&P 500 broke below 5,100, and was poised to halt a streak of five straight monthly gains. Megacaps sold off, with Amazon.com Inc.’s “show-me” moment arriving later Tuesday when its earnings become the latest test on artificial-intelligence spending.

Treasury two-year yields topped 5% — climbing to the highest level since November. The dollar headed toward its fourth consecutive monthly advance — the longest winning run since September 2022.

“Stocks, bonds, and the dollar are all frontrunning the possibility of a frowning Powell at tomorrow’s interest rate decision,” said Jose Torres at Interactive Brokers. “This morning’s data justifies an increasingly hawkish committee.”

A survey conducted by 22V Research shows that only 16% of investors polled expect a “risk-on” reaction to Wednesday’s Fed decision, 44% said “risk-off,” and 40% “negligible/mixed.” The tally also revealed that two thirds of respondents still expect a rate cut in 2024.

U.S. consumer confidence fell in April to the lowest since mid-2022 as Americans’ views of the labor market and their outlook for the economy deteriorated.

A broad gauge of labor costs closely watched by the Fed increased the most in a year, illustrating persistent wage pressures that are keeping inflation elevated.

“With inflation data continuing to be surprisingly hot for the past quarter, the narrative that these surprises are all attributable to ‘one offs’ in individual components is becoming harder to sustain,” said Joe Davis at Vanguard. “Time will tell, but the data suggest that what we call a ‘deferred landing’ is more likely than the long anticipated ‘soft landing’.”

April 30, 2024 at 02:57 PM

April 30, 2024 at 02:57 PM

Source: Bespoke Investment Group

Source: Bespoke Investment Group